Just a Data Girly Breaking Down the Rest of 2025

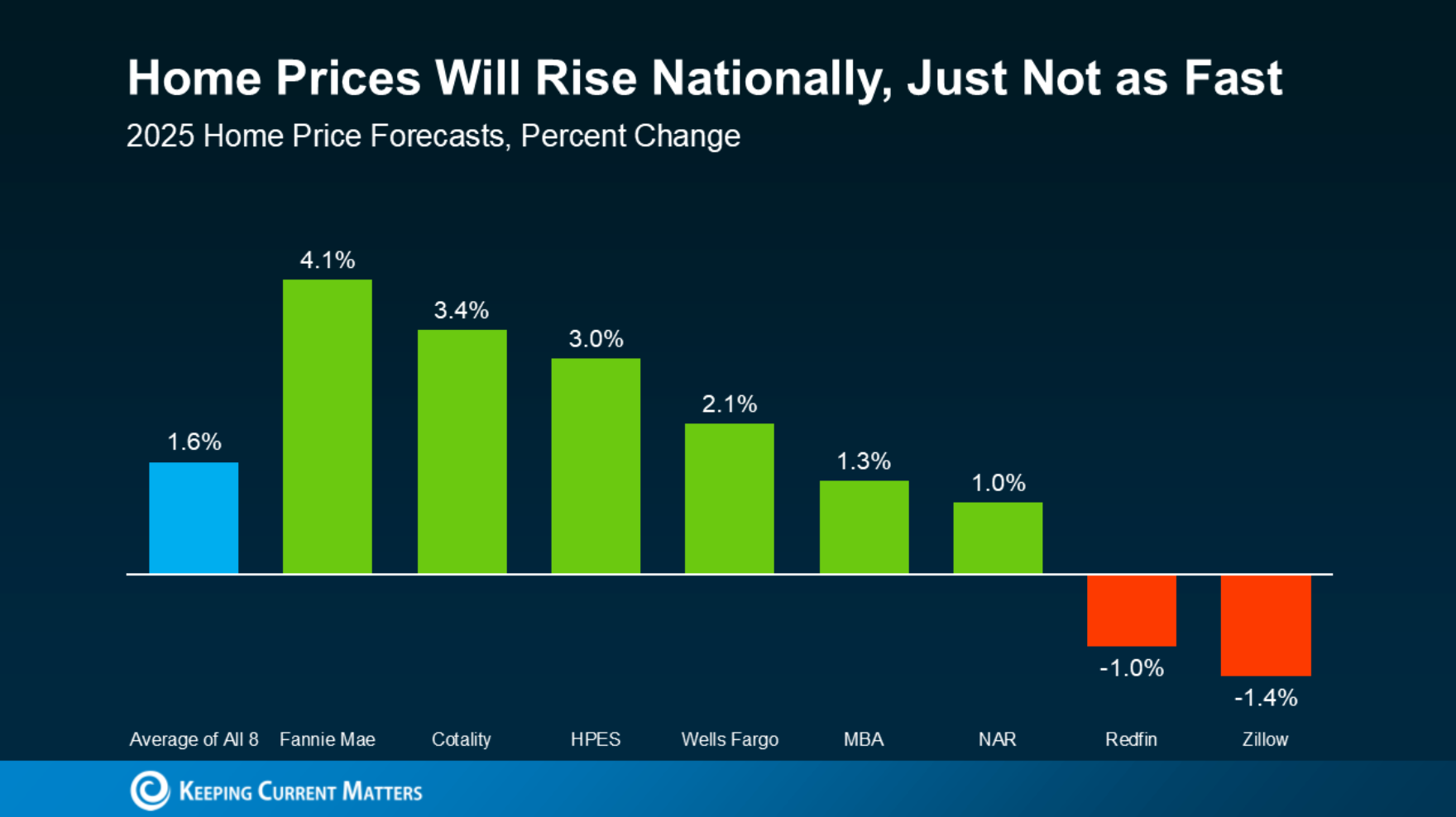

So What’s Really Coming? One of the most common questions in real estate right now is whether prices are finally about to come down. The answer, according to the data, is no.

Nationally, home prices are down about 3.5%, but compared to the nearly 20% plunge of the 2008 crash, that decline is hardly significant.

Since 2020, prices have climbed over 55% nationally, which means even small dips don’t come close to erasing those gains. For buyers, this feels discouraging, I know (don’t worry, I’m here to guide you through this & make things happen still!) For homeowners, you can take it as a reminder that your equity is solid.

But the bigger storyline isn’t prices, it’s interest rates. Many have been hoping the Federal Reserve would deliver dramatic cuts, making mortgages more affordable overnight. But the reality is… that’s unlikely.

Projections point to rates stabilizing in the mid-6% range through the end of 2025, which is right around where they are today.

That’s not a free fall some buyers dreamed of, but it’s also not a climb into the 7s or 8s that would have slowed the market to a literal crawl. Instead, it suggests we’re entering a period of relative rate stability, where affordability challenges won’t vanish but also won’t spiral further out of reach.

This stability has real psychological consequences for the market (no really though, so stick with me).

For the past two years, many buyers adopted a “wait and see” mentality: holding off in hopes that rates would come back down to pandemic-era lows (I was this buyer once). But if the consensus is that we’re not going back there anytime soon (if at all), waiting quickly becomes a losing strategy.

What we’re seeing now is the beginning of a mental reset:

Buyers are recalibrating what “normal” looks like and moving forward with purchases under the new rules of the game.

Sellers, in turn, are adjusting their pricing and negotiation strategies, knowing that buyers are still stretched thin but also less willing to delay.

One sort of fascinating trend worth noting is how this environment affects deal fallout rates.

This June (2025), about 15% of pending sales fell through (compared to a pre-pandemic norm of like 12%). Yes, that increase might not sound drastic, but from a Realtor perspective, it does reveal an important shift in buyer behavior.

With budgets stretched to the limit, buyers don’t have the appetite (or the $$) for unexpected repairs.

Inspections that once might have been brushed off, are now deal-breakers.

Add in the fact that there’s more inventory than in the ultra-tight days of 2021 & 2022, and buyers simply have more leverage to walk away.

For sellers, the lesson is clear: ignoring repair issues is riskier than ever.

I know they’re less common to do as of late, but a pre-listing inspection or upfront fixes may not only speed up your sale but also protect you from falling out of contract.

The rest of 2025 looks like a rebalancing act.

Prices are holding steady, rates are holding steady, and both sides of the table are learning to navigate within those boundaries. That doesn’t mean it’s “easy” though. Affordability is still a genuine challenge for most buyers. And sellers must be strategic to win attention.

I do feel that this does mean the market can be a little more predictable for us all, and predictability is a gift in real estate. When we can trust what’s going on, we’re able to make decisions with confidence rather than fear.

Looking Local: Western Suburbs

Real estate is always local. Always always always.

Yes, national headlines set the tone perhaps, but the real decisions buyers & sellers are making happen block by block, neighborhood by neighborhood, town by town.

The western suburbs of Chicagoland continue to be an interesting case study: each area is moving to its own rhythm, but the undercurrent is the same:

Steady Demand + Rising Inventory → Longer Market Times (but Well-Prepared Listings Still Win)

Take Elmhurst, for example.

This has long been one of the western suburbs’ crown jewels, and the data proves why. Even though the number of closed sales is down compared to last year, the average sales price climbed another 6% to $746,638.

What that tells us is simple: buyers may be more selective, but when the right Elmhurst property hits the market (especially those near the vibrant downtown corridor, Metra access, or top-ranked schools) they are still willing to compete and pay premium prices. For sellers, that means preparation and timing are everything. If your home shines, the demand is still there.

Glen Ellyn has been this season’s breakout performer.

Prices jumped an eye-popping 14% year-over-year, pushing the average to over $645,000. Closed sales also rose by a third, showing that buyers are hungry for Glen Ellyn’s mix of historic character and family-friendly amenities. Think of its walkable downtown, the lakefront at Lake Ellyn Park (where Alec and I like to walk the pups with coffee every Sat/Sun morning), and the charm of tree-lined streets where vintage Tudors sit beside thoughtfully updated modern homes.

This is the type of town where a beautifully staged home can draw multiple offers even in a “slower” climate, and the data proves it.

Moving west, Downers Grove tells a story of quiet strength.

While under-contract deals have dipped slightly, average sale prices still climbed 7% to reach $543,170.

What’s happening here is that inventory is giving buyers more room to breathe, but not enough to flip the balance of power.

Downers Grove continues to offer a mix of affordability and access. And this is why Downers Grove is arguably one of the area’s most balanced markets. Homes near the downtown Metra station, with its expanding restaurant scene and commuter appeal, remain especially attractive.

Then there’s Naperville, the town that raised yours truly!

Inventory here surged 46% compared to last year, giving buyers a dramatically wider set of options. For the first time in years, Naperville buyers can afford to be choosy (not across the board, but still).

Yet (buyers I’m holding your hand as I say this), even with this influx of homes, average prices still moved up 5% to just under $650,000. That combination (more choices without a collapse in pricing) shows how deep demand still runs for Naperville’s schools, amenities, and nationally ranked reputation as a best place to live.

For sellers, this shift means your competition is stiffer no doubt, but the payoff is still strong when your home is priced and marketed thoughtfully.

Heading further out along the Fox River, communities like St. Charles & Geneva are showing their resilience too.

In St. Charles, the average sales price jumped 9% to $586,773, with more homes going under contract this year than last. Geneva saw even bigger percentage gains in closed sales and broke into the mid-$550K average price range. These towns attract buyers who want a blend of suburban coziness with a sense of small-town charm, with scenic riverfronts and historic downtowns that give them an edge over more ‘generic’ subdivisions (you know who you are).

Their growth suggests that buyers are willing to drive a bit farther west if it means lifestyle and value align.

The common thread across all of these towns?

Buyers have more leverage than they did two years ago, and they haven’t disappeared.

The western suburbs remain fundamentally desirable, and price growth (even modest) proves it.

The listings that succeed are the ones that nail their pre-sale preparation & strategy, but also fully understand that today’s buyers are:

more value-conscious,

more inspection-sensitive,

and more likely to walk away if a property feels overpriced or underprepared.

Okay, One More Look at Data (I Swear)

When we zoom out, housing trends over time can tell us a powerful story that short-term headlines can’t realllly capture. Let’s look back the last 15 years, because I think it shows us how today’s market is a lot more resilient than it perhaps feels right now.

In DuPage County, average home prices peaked near $350,000 in 2008, then slid to just under $270,000 at the 2012 bottom. From there, the climb has been steady and strong, crossing $500,000 by 2025… almost doubling in just over a decade.

Kane County followed the same arc, starting from a lower baseline. Prices bottomed around $180,000 in 2012 but have since more than doubled, now sitting above $420,000.

HOMIES Takeaways

So what should you do with all of this information? The short answer: stop trying to play the guessing game. Rates aren’t crashing, prices aren’t plummeting, and waiting for a unicorn deal is likely to leave you stuck.

If you’re a buyer, focus on the right home for your lifestyle and budget, knowing that stability is here to stay.

If you’re a seller, invest in preparation and remember that your net (what you walk away with after everything) is far more important than trimming commissions, delaying repairs, etc.

2025 is shaping up to be the year of grounded decisions. And for us HOMIES, that’s good news. In a world of annoying headlines, the real edge is going to come from staying calm, staying informed, and moving with confidence. (and hiring me as your Realtor of course)